Diary of a Professional commodity Trader - Number 2 trading book ever

All technical analysis traders have heard of Technical Analysis of Stock Trends by Edwards and Magee, and many consider it the "bible" of pattern trading.

I've been trading markets for almost 30 years and I still refer back to Edwards and Magee.

Until now I'd considered the second ranked trading book to be "Trading for a Living by Alexander Elder, followed closely by "Reminiscences of a Stock Operator". But I've just bought myself a traders book for Christmas which I now consider sits firmly at number two.

If you trade using charts, and particularly use pattern recognition, then you must read and keep in your library, Diary of a Professional Commodity Trader by Peter L Brandy. It was published in 2011 but I hadn't come across it until now. I don't know Peter personally, I just commend him for what he has produced and recommend his book to serious traders.

See just some of the comments about the book below:

"We've all read about the high rollers who go boom and bust, but this book is

different. Packed with straightforward prose, practical knowledge and honest

counsel, Diary of a Professional Commodity Trader delivers far more than the

title promises. Peter Brandt methodically explains what no one has before: how a

dedicated individual can trade for a living. If that is your destination, this

is your ticket. "

- Robert Prechter, Elliott Wave International

"This book is insanely great. The refreshing clarity this book brings to the

table is brilliant. I think this is an amazing, excellent book, one that could

help a whole new generation of traders."

-Jack Sparrow

"This is the most honest trading book of the last decade. Peter tracks recent

trials and tribulations on his path to success dating back to the 1980s. He

shares numerous insights into the emotional and technical challenges of trading,

right down to his track record over the years. Peter candidly documents a recent

trading period. His ultimate success reflects the importance of staying true to

a process while still allowing flexibility to modify rules as market conditions

change. Anyone desiring longevity in the business really needs to read this

book."

- Linda Raschke, trader, President of LBRGroup, Inc., and co-author

of the best selling book, Street Smarts-High Probability Short Term Trading

Strategies.

Sunday, 30 December 2012

Saturday, 29 December 2012

EUR/USD long-term trend change

EUR/USD looks to have made a long-term trend change to the upside. A likely Head and shoulders bottom sets the potential for a rise to at least 1.4200. A clean upwards neckline break 3 weeks ago looks valid although the right shoulder is a little unsymmetrical in comparison to the left shoulder. A move back inside the neckline and certainly a fall below the right shoulder would invalidate the bullish view.

A pull-back to the 1.3130 to 1.3160 level is possible an would be a buying opportunity with stops below the right shoulder.

USD/JPY Bullish long-term

If you trade long-term then USD/JPY provide the opportunity 3 weeks ago to take a bullish stance for a large upside move.

USD/JPY finally broke up through a massive head and shoulders bottom formation with a weekly close above a neckline at 83.50. This invalidated the possibility that action since early 2011 had been a triangle continuation. It coincides with the BOJ putting the money printing presses in high gear which never bodes well for a currency's value.

The minimum upside count from this formation is around 92.00. It looks due for a bit of a correction in coming weeks though with a key reversal on Friday signalling a probable short-term consolidation. A possible downside target is firstly 85.00 and at the outside 83.00 the original breakout point of the H&S. So best to wait for the consolidation to play out and wait for a breakout from that for a resumption of the bull trend.

Sunday, 10 June 2012

GBP/USD set up for next big move

It's been a long drawn out process but Sterling looks to be close to breaking out of a large symmetrical triangle which has its origins back in January 2009. GBP just hung on to the lower boundary a couple of weeks ago, slightly breaching it during the week but recovering to close above the line.

Which way will it break? Best to just wait and see. I'm favouring the downside. The selling of the past couple of months was heavy and I don't think that momentum has ended yet. Another sell-off would most likely see the lower triangle boundary tested and breached.

The move either side of this triangle will be one worth being on. On the downside I'd expect the 1.3500 level to be revisited and I can make a case for 1.2200 should that support level fail. An upside break would imply a retest of 2008 resistance/former support levels in the 1998-2000 area.

|

| GBP/USD June 2012 |

Which way will it break? Best to just wait and see. I'm favouring the downside. The selling of the past couple of months was heavy and I don't think that momentum has ended yet. Another sell-off would most likely see the lower triangle boundary tested and breached.

The move either side of this triangle will be one worth being on. On the downside I'd expect the 1.3500 level to be revisited and I can make a case for 1.2200 should that support level fail. An upside break would imply a retest of 2008 resistance/former support levels in the 1998-2000 area.

Gold Descending Triangle Potential Bear Warning

|

| Daily Spot Gold |

Since topping above $1900 in early September 2011 Gold has eventually formed what looks like a very large descending triangle. Sometimes these patterns break on the upside but much more frequently the flat bottom and downward sloping upper trendline pattern eventually breaks to the downside.

Should Gold clearly break below $1520 the downside target is massive. The distance of the move is usually the width of the triangle. For Gold that would mean close to a $400 drop to around the $1120 to $1130 region. And that could happen quite quickly.

Fundamentally it's very hard to find many Gold bears out there which makes the potential for a large fall even more likely as the speculative market is long to the gunwales. I also very much favour a much more severe deflationary environment still to come before any reflation emerges.

Monday, 5 March 2012

Kiwi Triple Top Danger

The Kiwi (NZD/USD) has formed what could be a triple top. Three drives to make new highs have failed around the same level (8420-8470). The critical support level to watch is the 8240 to 8260 range. A daily close below that range would signal a possible large decline with no significant pull-back in the kiwi having occurred since December.

This pattern could also be viewed as a broadening formation - each top is slightly higher than the previous one. The base is slightly upward sloping from February but the downside implications are the same. A close above the upper line would negate the bearish scenario. The target on a downside break is at least 2cents but will often be much more.

Sunday, 5 February 2012

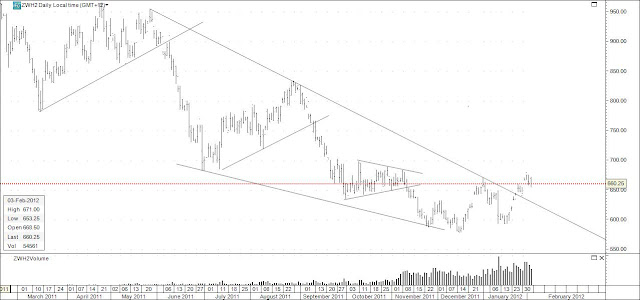

Wheat bullish wedge break

Most of the talk around at the moment is bearish for wheat with good rains forecast. However the technicals look more bullish. The March chart above shows wheat breaking up out of a large falling wedge. Wedges typically return to their starting point which in this case would be up around the 900 to 950 level. A move back down within the wedge would negate my bullish view.

Copper triangle breaks on the upside

In my December 26th, 2011 blog I warned that Copper was forming a clear converging symmetrical triangle and to wait for which way the market broke. Well as can be seen above Copper (March 2011) made a clear break to the upside and never looked back. It has hit resistance at what was previous strong support at around 390. However, the measuring implications from the triangle implies 420 is still a possibility. Probably wise to consider recent support in the 372-377 area as a stop-loss point.

Aussie Dollar triangle breakout

The weekly Aussie dollar chart above has now had 2 triangle breaks. One a few weeks ago around the 1.0500 level out of a large symmetrical triangle which started forming in July 2011, and another break upwards through an ascending or flat top triangle with the critical level being 1.0750. The measuring implications from even the smaller ascending triangle are huge with the potential for the Aussie to reach 1.21000 or about 13 cents higher. My only warning on this would that large triangles after markets have already moved a long way in the same direction can sometimes disappoint by not fulfilling all their measurement potential. However at this stage I'll go with the 1.21000 level.

Euro possible Head and Shoulders

The channel breakout in the Euro I pointed out in my previous euro update certainly proved to be important. Channel formations are not necessarily reversal patterns on their own but a potential Head and Shoulders bottom could be forming as well now with the neckline now around 1.32000. Should the Euro close clearly above this line I'd expect a further advance to the 1.3800 level. Often breaks from h&s patterns retrace to the breakout point before continuing the move in the direction of the original break. So watch out for that.

Of course on the fundamental side the next major move seems to hinge on Greek debt talks although as a technical analyst I try to ignore the news and focus on the price action. The market still feels like the big traders are very very short to me and that's a recipe for massive short covering should this pattern above play out.

Sunday, 29 January 2012

Euro bullish channel break

I always hesitate to say channel breaks are topping or bottoming formations. They very often signal at least a temporary end to the most recent trend. The significance of the break also seems to depend on how many times it's boundaries have been tested, the length of time within the channel, and the steepness of it. A very sharply sloping channel break will often mean another less sharp formation is being constructed.

However the upwards channel break in the EUR/USD with strong daily closes was not to be ignored. It is too early to tell if the larger major trend has finished but it is a warning short was not a place to be when this broke. Record numbers of futures net short Euro positions was also a bullish sign.

Subscribe to:

Comments (Atom)